ebike tax credit income limit

Therefore the composite return Form NJ-1080C uses the highest tax bracket of 1075. The e-bike tax credit would phase out at 75000 adjusted gross income for individual taxpayers 112500 for heads of household and 150000 for married filing jointly.

/GettyImages-1139717357-20236dae817d4164bef9d05504059bc7.jpg)

E Bike Incentives In Tax Bill Are Laughable Compared To Those For Electric Cars

Credit for certain new electric bicycles.

. Individuals may claim the credit for one electric bicycle per year. Also use Form 8936 to figure your credit. Your gross income is more than 20000 10000 if filing status is single or marriedCU partner filing separate return or you and or your spousecivil union partner if filing jointly were 65 or older or blind or disabled on the last day of the tax year.

In the updated bill a 15 tax credit would be available for the purchase of an e-bike up to 5000 meaning a maximum credit of 750. Joint filers who make up to 150000 can qualify for two bikes and up to a 900 tax. A tax credit is better than a tax deduction.

This requirement went into effect on August 17 2022. Individuals who make 75000 or less qualify for the maximum credit of up to 900. The credit begins to phase out for a manufacturer when that manufacturer sells.

Ebike tax credit income limit Saturday April 23 2022 Edit. Joint filers who make up to 150000 can qualify for two bikes and up to a 900 tax credit on each. A In general Subpart C of part IV of subchapter A of chapter 1 of the Internal Revenue Code of 1986 is amended by adding at.

This is an electric bicycle. Residents with gross income of 20000 or less 10000 if filing status is. New Jersey has a graduated Income Tax rate which means it imposes a higher tax rate the higher the income.

New Jersey allows a deduction of medical expenses including long-term care insurance premiums to the extent that they exceed 2 of adjusted gross income. The credit ranges between 2500 and 7500 depending on the capacity of the battery. The new bill also puts income limits.

E Bike Incentive Programs In North America N Eurekalert At of 10-28-21 the. E-bike purchases are eligible for a refundable tax credit of 30 percent up to 1500. Use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year.

The credit begins to phase out above those income levels at a rate of 200 per 1000 of additional income. The tax credit for your e-bike purchase is a percentage of the purchase price of the electric bike. Section 30D of the Internal Revenue Code offers a credit for Qualified Plug-in Electric Drive Motor Vehicles such as passenger cars and.

There now also exists an income based phase out of the credit applicable to those earning over. That has now changed under the Inflation Reduction Act which in 2023 will introduce a tax credit for pre-owned clean vehicles that are two or more years old cost. Since a composite return is a combination of various individuals various rates cannot be assessed.

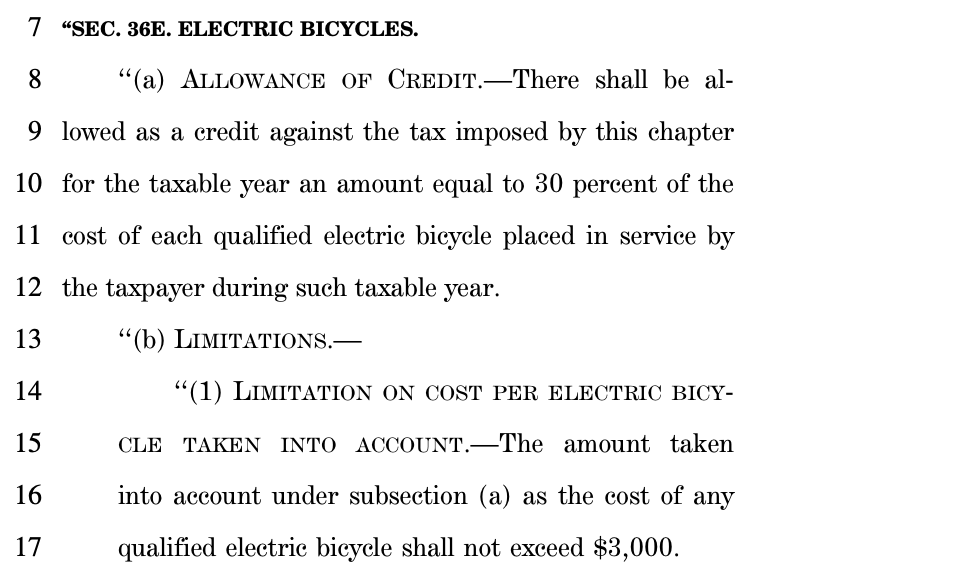

USAs e-Bike tax credit moves along but is halved 16 September 2021. As it stands the bill provides a credit of 30 for up to 3000 spent on a new e-bike excluding bikes that cost more. A deduction means that lets say you make 40000 a year and after all your income is added up you get to calculate all your allowable deductions.

This is not the motorcycle youre looking for. Narcise CPA is the partner in charge of the Real Estate Construction Services Group specializing in all areas of accounting audit and tax for family. All three types of e-bikes qualify for tax credits except for those with motors more.

Guide To State Local E Bike Rebates And Tax Credits Juiced Bikes

Electric Bikes Sparking Increased Interest Albuquerque Journal

E Bikes Out Of Climate Bill The Federal Bill Is Missing The Most Effective Rebate Program

Policy On Electric Bike Subsidies And Tax Rebates

E Bikes Out Of Climate Bill The Federal Bill Is Missing The Most Effective Rebate Program

Electric Bicycle Incentives Go Local Peopleforbikes

Tax Credits De Co Drive Electric Colorado

Us Tax Credit For Electric Motorcycles Jumps To 7 500 E Bikes Get 1 500

Understanding The Electric Bike Tax Credit

Federal E Car Incentives Get 4b E Bikes Still In Limbo Streetsblog Usa

/cdn.vox-cdn.com/uploads/chorus_asset/file/22181315/VRG_ILLO_4348_BikeBoom.jpg)

The E Bike Tax Credit Is Only Mostly Dead As Supporters Plot Next Steps

E Bike Legislation Regulating Electric Bicycles Duane Morris Government Strategies Dmgs

The Monday Roundup Money For E Bikes Black Urbanists You Should Know Secure Bike Routes And More Bikeportland

Tax Credit For Electric Bike Purchases In Us Makes Progress But At A Cost

David Zipper On Twitter Notably Individuals Must Make Less Than 75k To Claim The Full 900 E Bike Credit By My Math You Can T Get Anything For It If You Make Over 83k

Biden S Compromise Legislation Platform Returns E Bike Tax Credit To Original Rate Bicycle Retailer And Industry News

Us Tax Credit For Electric Bicycle Purchases Back Up To 30 In New Proposal

Ebike News E Bike Tax Credits Back On Track New Schwinn And Gazelle E Bikes And Much More Electric Bike Report Electric Bike Ebikes Electric Bicycles E Bike Reviews