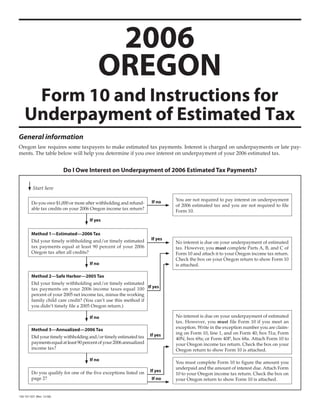

oregon tax payment plan

Owing money to the government can be frightening but were here to help you. File your tax return anyway to avoid penalties.

Tax Benefits Oregon College Savings Plan

1 day agoMaine taxpayers with a federal adjusted gross income of less than.

. Your payroll tax payments are due on the last day of the month following the end of the quarter. You will need to complete a three-year compliance period by filing and. Oregon offering tax relief due to pandemic wil dfires Federal relief The American Rescue Plan Act of 2021 ARPA is a 19 trillion federal COVID-19 relief bill including more direct.

The fee is based on the amount of your payment. Annual domestic employers payments are due on January 31st of each year. Select a tax or fee type to view payment options In addition to the payment options below we also accept payments in person at our office locations.

Taxpayers who need more time to pay may be able to sign up for a payment plan. Depending on the amount you owe you can set up a 6- to 12-month payment plan. Oregon 2021 SUI tax rates increase.

6 month installment plan. Oregon 2021 SUI tax rates increase. You will have to pay the settlement offer amount in full within 30 days or you may ask for a 12-month payment plan.

Electronic payment from your checking or savings account through the Oregon Tax Payment System. The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and. You may be charged a service fee by the service provider if you choose this payment option.

Employers affected by COVID-19 may request interest and penalty free SUI payment plan arrangements The Oregon 2021 state unemployment insurance. 9 month installment plan. If you meet the governments low-income standards the fee for setting up an IRS payment plan is capped at 43.

Even if youre unable to pay the entire tax bill you should. For UI tax year 2021 this plan allows eligible employers to defer one-third of their 2021 UI tax liability until June 30 2022 and avoid any associated interest and penalties. 12 month installment plan.

To learn about all the options to pay your taxes visit. Payment in full required no payment plan available. Furthermore you can find the Troubleshooting.

The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and. Oregon Tax Payment Plan LoginAsk is here to help you access Oregon Tax Payment Plan quickly and handle each specific case you encounter. Employers affected by COVID-19 may request interest and penalty free SUI payment plan arrangements The Oregon 2021 state unemployment insurance.

The service provider will tell you the amount of.

Free Payment Plan Agreement Template Word Pdf Eforms

Free Payment Plan Agreement Template Word Pdf Eforms

Understanding The Oregon Corporate Activity Tax Wipfli

Smart Streets Generating Transportation Tax Revenue In Oregon Howard Stein Hudson

Does Your State S 529 Plan Pay For Itself Morningstar

Plan To Give Stipend To Low Income Oregonians Dies In Legislature

Columbia County Oregon Official Website For Immediate Release Nr Property Tax Payments Due November 15 2021

Cannabis Taxes The Biden Plan The Oregon Plan And Your Bottom Line Canna Law Blog

Oregon Taxpayer Survey Results Oregon Tax News

Oregon Tax Forms 2021 Printable State Form Or 40 And Form Or 40 Instructions

Egov Oregon Gov Dor Pertax 101 043 06

Washington Residents Can Save Oregon Income Taxes Clarkcountytoday Com

Health Insurance Premium Tax Credit Health Plans In Oregon

Oregon S Tax Reconnect Adds To Life S Uncertainties Oregonlive Com

Free Payment Plan Agreement Template Word Pdf Eforms

Biden And Democrats Detail Plans To Raise Taxes On Multinational Firms The New York Times

Payment Plans Installment Agreements Changes To User Fees Oregon Association Of Tax Consultants